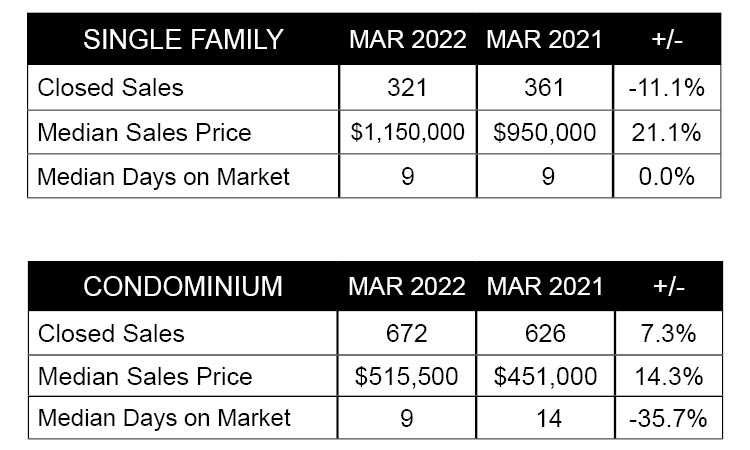

The first quarter of 2022 closed with new record median sales prices for both single-family homes and condos at $1,150,000 and $515,500, respectively. The March median sales price for single-family homes reflects a 21.1% increase from last year and is 2.2% above the previous record of $1,125,000 set just a month ago. The condo market’s median sales price of $515,500 represents a 14.3% hike compared to this time last year and a 1.1% increase from the prior record of $510,000 set in January 2022.

In March, single-family home sales fell 11.1% year-over-year, while the condo market sales volume remained strong with a 7.3% rise compared to March last year. Combined sales saw a modest bump, 0.6% compared to March 2021 sales.

Fewer single-family homes were sold in March and the first quarter, with the most significant decline occurring in the $899,999 and below range, down 56.3% with just 70 closings in March. On the other end, the luxury single-family home market is picking up with 27 single-family homes sold in the $3 million and above range, marking a 68.8% jump year-over-year. In the condo market, sales in the $700,000 to $799,999 range recorded the highest volume increase, up 125.8%, with most of these sales occurring in the Metro and Ewa Plain regions.

Several regions across O‘ahu marked a boost in single-family home sales in Q1, including Waipahu, Hawai‘i Kai, and Leeward, up 50%, 18%, and 16%, respectively. The largest declines in this market occurred in the Diamond Head and North Shore regions, down 22% and 36%, respectively.

In the first quarter of 2022, 58% of single-family homes sold above the original asking price, up slightly from 52% in the first quarter of 2021. Similarly, approximately 42% of condos sold above the original list price compared to 29% in the same period last year. In both markets, properties sold in March were on the market for a median of nine days.

New listings for single-family homes continue to lag behind last year, with 412 new properties listed in March or a 6.2% dip compared to this time last year. Buyers scooped up the inventory quickly – approximately 56% of those new listings were in escrow or sold by the end of the month. New listings for condos were on pace with March 2021.

Active inventory of single-family homes is down 5.0% from a year ago, while active inventory for condos fell even further in recent months, dipping 26.9% compared to March 2021. Pending sales are outpacing March 2021 activity, up 3.8% for single-family homes and 5.3% for condos.

Go to Market Report Top Page >

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link