Summer Slump in Honolulu Real Estate Sales Continues Amidst Rising Borrowing Costs

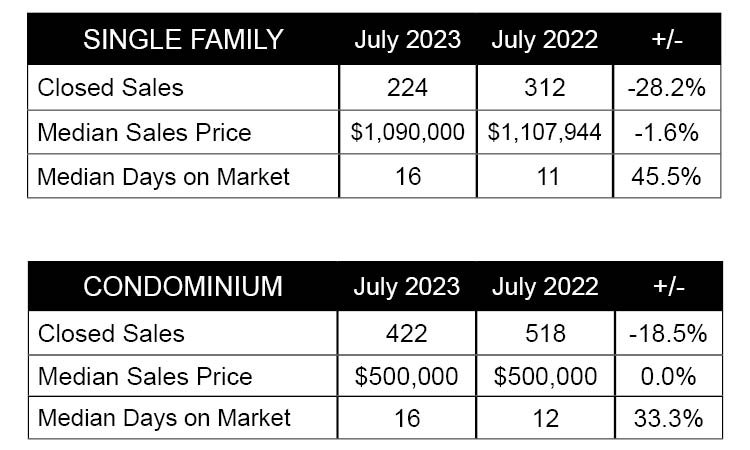

According to resale figures released today by the Honolulu Board of REALTORS®, both single-family homes and condos experienced a slump in sales as elevated borrowing costs continued to dampen summer buying activity. Single-family home sales fell by 28.2%, and condo sales dropped by 18.5% compared to the same time last year. In both markets, properties that sold in July spent a median of 16 days on the market, just a slight jump up from July 2022, where single-family homes had a median of 11 days and condos had 12 days.

Median sales prices were stable year-over-year, with single-family homes down 1.6% to $1,090,000 and condos even at $500,000. Approximately 53% of single-family home sales closed for the full asking price or more, compared to 65% a year ago. In the condo market, 47% of sales received the total asking price or more compared to 60% of sales in July 2022.

The market also experienced a decline in new listings, with a 28.8% year-over-year drop for single-family homes and a 15.4% fall for condos. However, active inventory for single-family homes and condos remained relatively unchanged from the previous year, with a modest 2.6% growth in active single-family home listings and 9.9% in active condo listings.

Despite a weakening in contract signings from a year ago, July 2023 saw a 6.9% month over-month hike for single-family homes and a 1.4% bump for condos. There were 247 pending sales for single-family homes and 421 for condos during the month. Notably, Ewa Plain, Waipahu, and Pearl City saw increased contract signings for single-family homes, with growth rates of 18.5%, 18.8%, and 13.3%, respectively. The Leeward region stood out for condos, experiencing a significant 92.3% boost in contract signings year-over-year. Ewa Plain condo pending sales remained steady year-over-year but rose by 38.2% from June to July.

Courtesy of the Honolulu Board of Realtors

Go to Market Report Top Page >

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link